Living Trust Michigan Form

Po box 30214.

Living trust michigan form. Charitable trust section. In some instances because all consumers are sold the same package the living trust may be ill suited or even contrary to individual estate planning needs. Lansing mi 48909. Return the completed form.

Our free michigan living trust forms are very popular estate planning tools that can be utilized to avoid probate and court supervision of your assets. Unscrupulous living trust sales people may charge thousands of dollars for what amounts to a set of pre printed legal forms. Michigan department of attorney general. The contents of your trust remain private because a living trust in michigan avoids probate court.

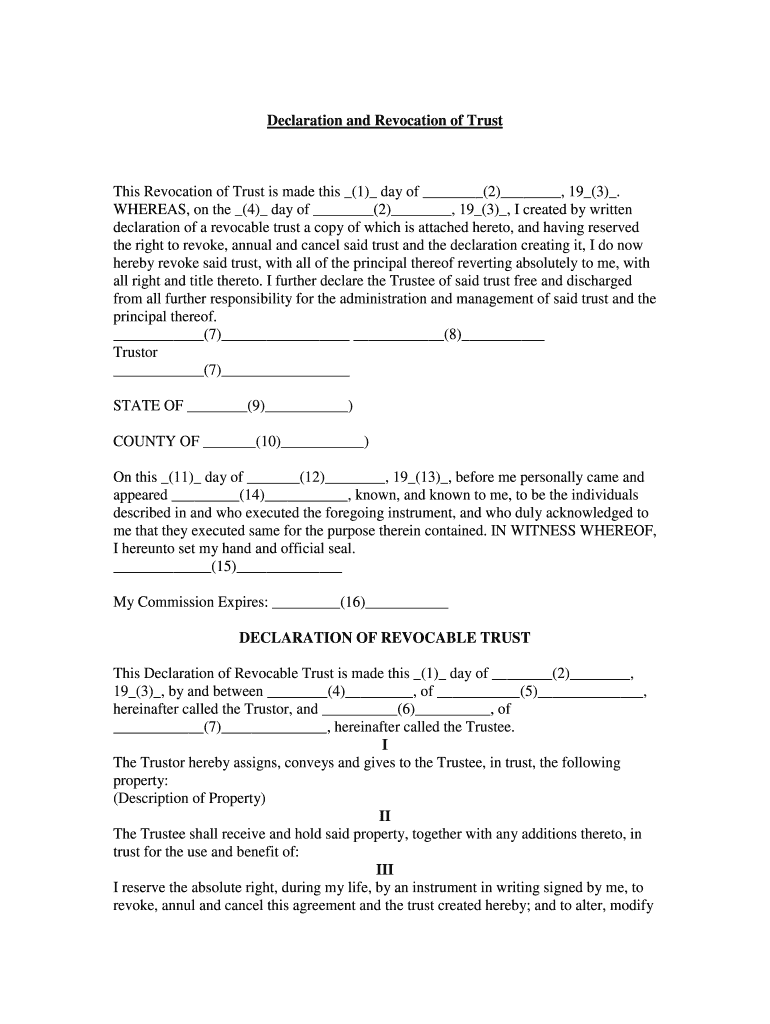

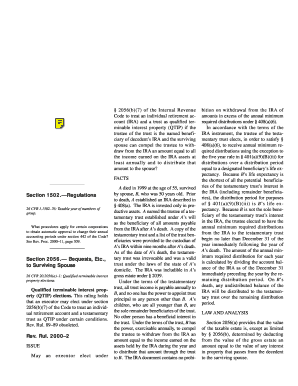

A trust provides flexibility in that a grantor can designate when and how the assets will be distributed to the beneficiaries. Download a michigan living trust form which is a way to transfer property and assets to a separate entity for the benefit of another. See also indexes for general general civil and general probate forms for other forms which are used in probate estate and trust proceedings as appropriate. A living trust such as a will substitute that is now irrevocable and has terminated or is terminating.

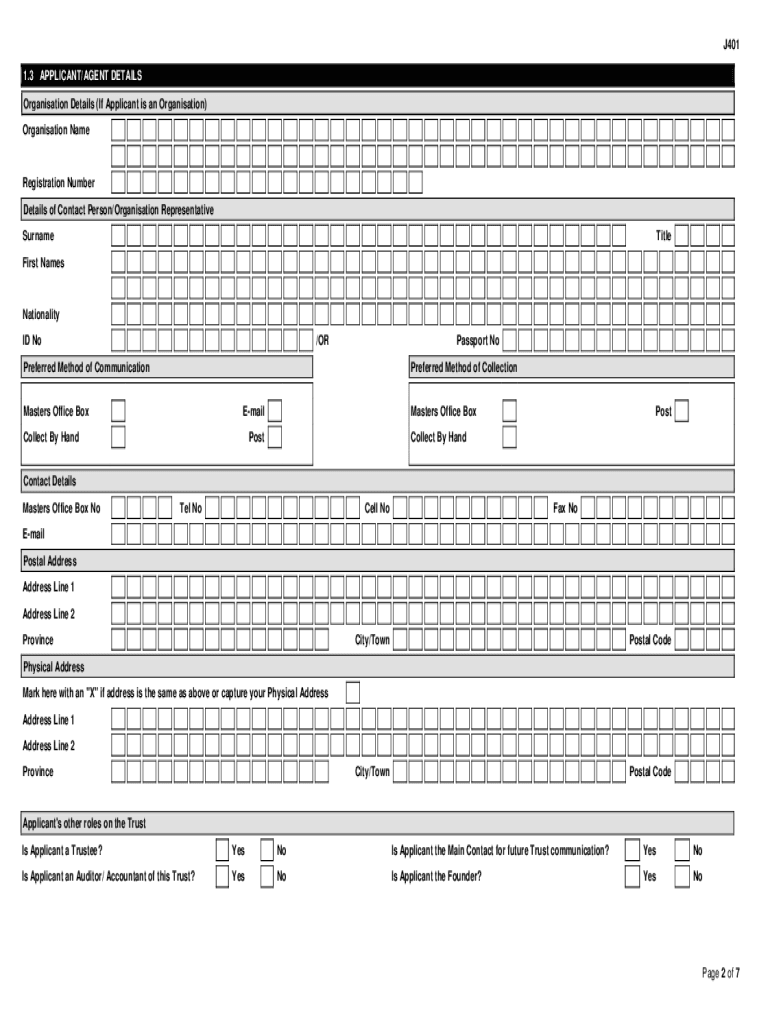

Index of scao approved forms for use in estates and trusts this set of forms is for use in probate proceedings. The deed should be signed and recorded in the local recorder office where the real property is located. Michigan uses the uniform probate code which simplifies the probate process so making a living trust may be more trouble than it saves. Whereas a will necessitates a court to probate litigate and approve and distribute an estate to its beneficiaries a living trust avoids probate altogether.

Michigan living trust forms irrevocable revocable the michigan living trust acts much in the same way as a will with certain important differences. Michigan has a simplified probate process for small estates under 15 000. A michigan living trust form is a legal document that is drafted to transfer a person s assets on to their named beneficiaries upon death. Since the trust avoids probate the contents of the transfer stays private.

Michigan revocable living trust form the michigan revocable living trust is a legal instrument which is used to avoid probate when performing the disposition of an estate. The forms must be filed in the probate court. For an example a grantor can impose an age restriction on the asset distribution or a require that the assets be spent only on certain.